The Latest in ATM Technology

ATM's have become a way of life that many Americans depend on for all of their banking activities. Some ATM's now have the ability to accept cash as well as multiple check deposits with no envelope required. Some have software embedded that can prepare a mini-statement and others can accept loan payments.

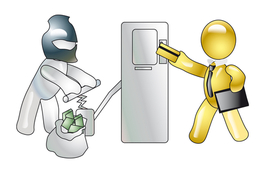

With all the new services and technology available, ATM manufacturers' top concern is protecting the customer as well as the owner of the machines. Criminals have become as sophisticated as the software. In some instances, they are able to get encrypted passwords and information from afar.

ATM features, security and technology all vary based on the type of ATM machine you choose and supplier you select. We break it down for you below:

On premise ATMs

On premise ATMs are typically a part of a financial institution's building or drive-through. With these ATMs, banking customers can:

- Deposit cash into checking and savings

- Deposit multiple checks without filling out an envelope

- Withdraw cash from checking, savings or credit card

- Receive an instant bank statement

- Make payments on loans and credit cards

- Request emailed receipts rather than a receipt from the machine

Off premise ATMs

However, there are off premise ATMs that are not located near a banking center and may be in a convenience store, retail store, restaurant, entertainment venue, etc. These ATMs are for withdrawing funds only. Features and benefits for the consumer include:

- Withdraw cash from checking, savings or credit card

- Ability to check balances

- Printed receipt with transaction

ATM security technology

If you are considering purchasing or leasing an ATM for your property, the very first thing that you need to find out is if the ATM is CPI Compliant. Credit card associations take fraud seriously.

According to First Data Corporation, the Identity Theft Assistance Center (ITAC) says that security breaches are up 47% since 2004, with damages due to cybercrime - costing approximately $100 billion annually and expected to increase. A consumer Web site that tracks and posts security breaches, InsideIDTheft.info, reports that in the last five years, approximately 500 million records containing personal identifying information of U.S. residents stored in government and corporate databases were either lost or stolen.

To combat this epidemic, credit card associations have established guidelines and rules that must be met to protect card holders as well as banking institutions. All of the credit cards perform periodic checks of machines as well as merchants to establish that all the criteria is being met. If it isn't, the merchant may lose the right to accept the cards as a means of payment and also as a means to withdraw cash from an ATM.

The fines are quite hefty. It is paramount that any ATM be CPI Compliant.

Manufacturers meeting standards

The top ATM manufacturers have included the latest in ATM security and technology in their most recent models. In some cases, when everything else is equal, the ATM security features can be the fulcrum that swings the pendulum one way or another.

Here are some of the ATM security features that have been introduced or expanded by some of the top manufacturers:

Diebold

Diebold's card and currency fraud-prevention solutions for Opteva(r) to protect consumers, their personal information and their assets. Diebold's fraud-prevention solutions protect against ATM fraud, including:

- ATM card skimming

- Card trapping and fishing

- Shoulder surfing

- PIN interception

- Dispenser trapping

- False transaction reversal

- Dispenser false front

- Burglary at the self-service channel

Triton

Triton has become a leader in offering ATM technology to negate security threats. EMV is an initiative to mitigate credit and debit card skimming and card duplication activities through the use of an integrated circuit chip (ICC) embedded on the face of the credit and debit card.

EMV chip-based payment cards, also known as smart cards, contain an embedded microprocessor chip. The chip contains the information needed to use the card for payment and is protected by various security features. This helps prevent counterfeit and lost and stolen card fraud.

Since EMV chip cards are a more secure alternative to traditional magnetic stripe payment cards, both MasterCard and VISA have given directives that all card issuers be in EMV compliance by 2016. Triton leads the way to EMV compliance requirements with US EMV upgrade kits that include EMV/CHIP card readers and EMV-compliant software for all Triton ATM models.

NCR

NCR's multi-layered approach to protecting card holder data offers choice and flexibility in reducing risk. It ranges from countermeasures, such as the Fraudulent Device Inhibitor (FDI) with Jitter, integration and support of multi-vendor third party solutions, to NCR's next generation active fraud prevention measures. NCR's PTS-DSS approved EPP keyboards support PCI-DSS requirements as well as Remote Key Management (RKM).

Searching for the right ATM for your business can be a complex challenge. Out-dated models are not secure and pose serious security threats to you and your customers. Let BuyerZone connect you to a supplier with the latest in ATM security and ATM technology - at a price that meets your budget.

Ready to Compare ATM Machines Price Quotes?